Success stories

“It’s not just being given $100 here and there to help with a bill—the benefit is long-term because now I’ll be able to pay my monthly bill on my fixed income and stay warm.”

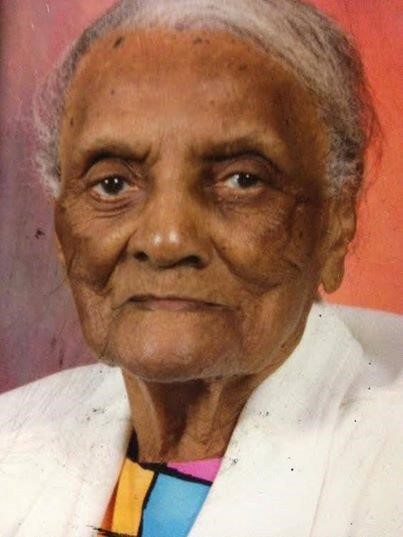

“Because of CCSP and the support of my family, I am able to remain in my own home.”

“It [Early Head Start] is so much more than daycare. They [the teachers] really sit down with him. He is already saying his letters and can count. I want him to have a good education.”

“It’s not just being given $100 here and there to help with a bill—the benefit is long-term because now I’ll be able to pay my monthly bill on my fixed income and stay warm.”

ADMINISTRATIVE OFFICES

Waycross office

912-285-6083

510 Tebeau Street

Waycross, GA 31501

Reidsville office

912-557-6687

111 Medical Arts Drive

Reidsville, GA 30453